In the last meeting of the Entrepreneur discussion group, we talked about business plans for our different ideas. Most businesses (Profit/Non-Profit, Product/Service...) that require some level of investment, fit into a similar planning pattern. We looked over one planning tool that I developed in Excel as an example of that pattern, which is then reflected in the example business plan that I posted to out Dropbox share (email me if you'd like access).

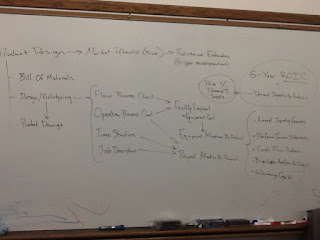

The model works by developing the product and estimating it's price and market potential (revenue projections). Next, you develop the cost model (bill of materials, equipment, facility, labor, administrative). These costs are allocated by product (or service) and together, the revenue and cost projections form the key financial data (Annual Operating Expenses, Pro-Forma Income Statements, Cash Flow Analysis, Breakeven Analysis By Product, Working Capital Requirements). All of these are based on research and best-guess assumptions.

The final result is a %ROIC (Return on Invested Capital). This is the number that investors really care about, because it reflects the % return on their money. Finally, Sensitivity Analysis looks at how robust the model is. If your sales, product mix, price, materials costs, etc... don't meet your expectations, how far off can they be before your model isn't viable?

At the next meeting on March 24th @ 6pm, we'll review the model for any newcomers and apply it to some of our ideas to gain a better understanding of how it works and what it means.

Comments

Post a Comment